How we can help with

Selling your company

You might want to consider selling your company. Independent of the reason why you are selling your company, we provide you with strategic guidance and support in the preparation and throughout the process. Our advisory will cover key aspects such as valuation, identifying potential buyers or partners, structuring the sale, legal and financial considerations, due diligence preparation, and developing a comprehensive exit strategy.

Your challenges are taken care of

You are considering selling your business to a strategic buyer.

You would like to sell your company in order to reorient yourself.

You want to sell your company for economic reasons.

Do you want to transfer your business to a family member or someone in your company?

You would like to spin off part of your company and sell it to a strategic partner.

You want to prepare your company sale in the long term.

Project-lead by a senior partner

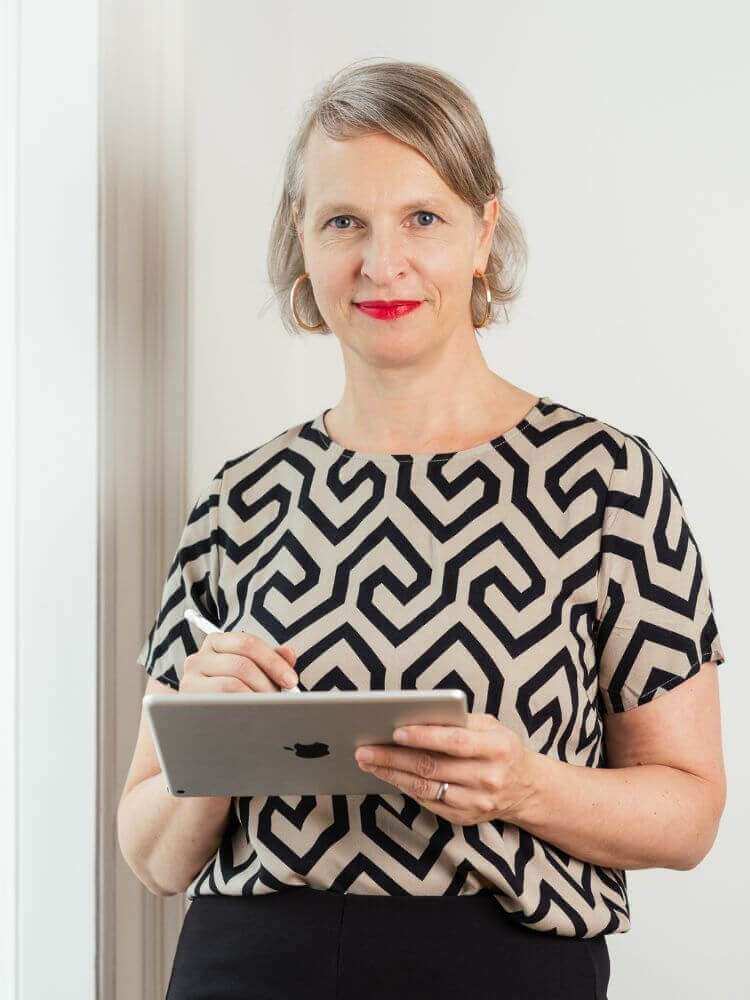

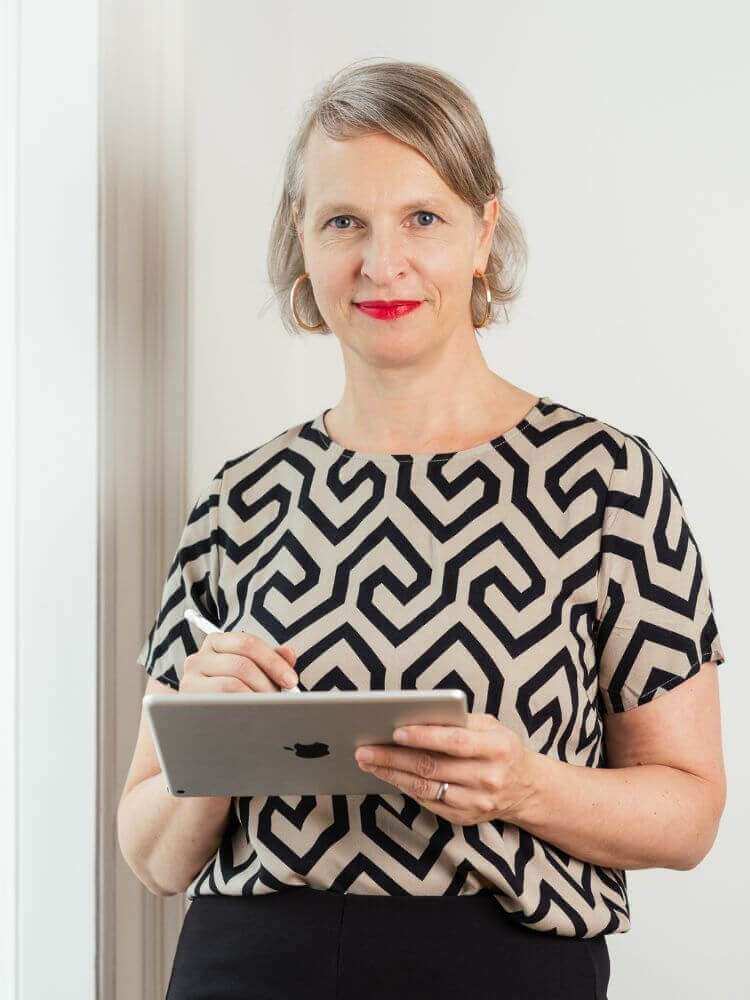

Petra Wolkenstein, CEO Konsultori

Petra is a highly accomplished professional with a wealth of experience in strategy and driving business growth. She specializes in providing strategic guidance and expertise in the areas of strategy, M&A, and growth. Petra is also an Investor and General Partner for Africa Startup Wise Guys, actively supporting and nurturing innovative startups in Africa.

With hands-on experience working with startups and investors since 2012, Petra has successfully led funding rounds and sales in diverse industries such as cybersecurity, eCommerce, SaaS and HealthTech. Petra’s extensive expertise, coupled with her proven ability to drive growth and navigate complex business areas, make her a valuable asset in the fields of strategy, M&A, and business development.

Expert partners

Work with experienced partners and benefit from their knowledge, proven strategies and decades of experience.

Hands-on Guidance

Receive ongoing, hands-on guidance to ensure effective and practical solutions throughout the process.

Diverse expertise

Access a broad range of expertise across strategy, organization design and finance, using trusted frameworks.

Tailored Solutions

Receive actionable advice tailored to your specific needs to ensure your company achieves its goals.

Areas in which we work with you

Key elements of work

- Strategic reorientation after handover

- Profiling and approach to potential partners or buyers

- Comprehensive financial plan

- Thorough business valuation

- Negotiation guidance

- Templates for financial and action plans

Results you will get

Action and financial plans

Process definition with milestones

Sales documentation and Due Diligence preparation

Business valuation and negotiation support

Expertise we bring

EU-certified international transfer consultant

In 2017 Konsultori became a certified international, cross-border transfer consultant under the EU project DANAE “Advisors in a Novel SME Transfer”

20 years of M&A experience

We have been active in the M&A sector for over 20 years (acquisition and sale of businesses and business shares).

Financial planning

In the creative industries and technology sector especially (platform model, SaaS model, corporate sales), we have several years of experience and provide templates for financial planning which are challenged using benchmarks.

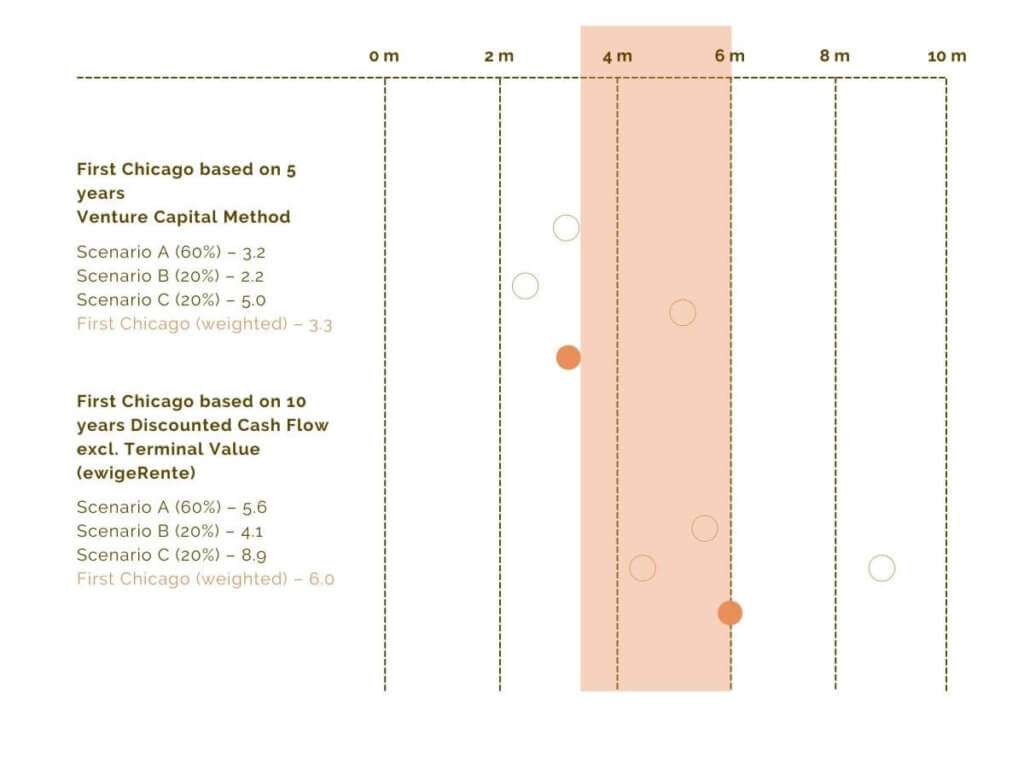

Business valuation

With 20’ years M&A experience in the corporate and startup scene, project management and keeping tight deadlines in mind is second nature to us. Assisting our clients with briefing and debriefing on future procedures during the negotiation process is also nothing new to us.

Petra Wolkenstein you are one of the best coaches I have ever seen!

Very competent in providing tools and strategies. I always feel a genuine passion for the mission to empower startups. Thank you!

Konsultori and Petra Wolkenstein are extremely professional. Her experience really helped us to get through the first funding round. We were thrilled that the documents and arguments which we produced in the preparations stage were so well received in our search for investors and during negotiations. I appreciated such a straightforward, hassle-free and honest partner who never forgot our goals and timeline. Without Konsultori, we’d never have managed to achieve everything within such a short space of time.

Our participants enjoyed her session on Negotiation In Action which imparted them with the confidence to get what they want. Petra shared her most important negotiation techniques, practical exercises as well as a confidence-building framework that the leaders can put into practice right away!

Petra Wolkenstein your lecture on negotiation was so insightful and engaging, thank you! You are a great storyteller!

Thank you a lot for the session this week! Some of the feedback from the founders (NPS 100!). “The practical approach. Petra was super useful and clear and knowledgeable. The practical exercise super useful points for the negotiations. The combination of theory and practice. Even though we only learned about term sheets the negotiation practice was very useful and, in fact, helped us understand terms sheets better. The exercise was really interesting and a good insight into negotiation practice. It has been really great the best exercise I’ve done in the startup world!”

I really enjoyed the workshop with you and many of my TU Wien Innovation Incubation Center pals the other day! Honestly one of the best workshops I have ever attended and probably with much more interaction from all sides compared to some offline workshops.

Hey Petra! Really enjoyed your session. Valuable content and learnings.

Thank you Petra! I want to share the comments received from the founders on the feedback form: “Amazing lesson should be a must for any founder, and life in general.It was really useful from a practical standpoint, clearly and helpfully delivered and felt like a safe space to learn, make mistakes, grow better. This is really great, would love to have more practice on this topic, and so I am going to make sure I use any materials available to work on it more.Great session. ! I don’t like role plays so was dreading it, but that was very useful. Thank you! The practice part was very cool a bit more of „hardcore“ examples and tactics, seemed too nice! Interesting topic I was expecting to get to go more in depth of special techniques of negotiation, maybe doing the simulation after the explanation of techniques so that you can apply. Liked all of it! The interactive element was strong and really enjoyable.”

The #LeadF programme provided the space and guidance for introspection, allowing me to reflect on my journey thus far and lay the groundwork for a more rewarding and enduring entrepreneurial adventure. I’m immensely grateful for all sessions held by Rebecca Williams, Annabelle Bockwoldt, Emma Stamiri, Amelia Suda-Gosch, Nina Mueller, Rupal Patel, Paulo André, Petra Wolkenstein, Preethi Sundaram. Your stories have enabled me to gain a deeper understanding of myself and chart a path for continued growth.

I run the Vienna Business Agency’s “Founders Lab” programme, during which I provide intensive support to early-stage start-ups over three months. Workshops and coaching sessions with Konsultori are a central part of the programme. The founders, regardless of their industry, benefit enormously from Petra’s, Franziska’s and Joachim’s input on the topics of business modelling, finance, negotiations and investments. Konsultori’s wealth of experience, expertise and approachability is a great asset to the startup ecosystem in Vienna.

Our collaboration with Petra has been a privilege, and without hesitation, we attest to her skills as a mentor and industry expert. Given Grayn’s position as an innovative technology company, with a focus on both environmental and social impact data, Petra’s guidance has played a pivotal role in navigating the intricacies of our expansion into the DACH region, specifically Austria. By leveraging our carefully crafted sales and market expansion strategy, Grayn achieved a heightened level of efficiency and success in penetrating the Austrian market. Petra’s expertise played a vital role in this accomplishment, allowing us to navigate the complexities of the local business landscape with confidence and precision. As a result, we were able to establish a strong foothold and make significant progress in our mission to promote sustainable accounting practices in Austria.

I had the privilege to widen my skills through the Female Founders program #LeadF and learn from top-class speakers such as Petra Wolkenstein, Rebecca Williams and Preethi Sundaram just to name a few! Thank you!

Petra Wolkenstein’s coaching for LENA is brilliant. She works in a structured way but is always open to out-of-the-box thinking. She takes an analytical approach and inspires us with her input and ideas. Her great sense of humour makes every session feel more like fun than work.

I just re-watched your videos. They are fantastic! Thank you for such a structured attitude. The “templates-based” training is excellent! Also, lots of great insights into how an investor thinks during the Q&A sessions.

Hi, once again Petra! Thank you for such an energetic session. It is absolutely excellent and highly valuable.

Competence. Experience. Excellence. Full Commitment! Thank you for all the great workshops and the coaching.

Petra helped us in structuring the key message and all relating documents for finding venture capital for a newly founded start-up in the field of green chemicals. Petra also provided us contacts and venture opportunities for our mission. We totally appreciated Petras’s very experienced, well-skilled but still hands-on way of working with us. Petra is perfectly capable of sensing what her customers really need. We really learned a lot! Thank you, Petra.

Petra’s highly structured and positive approach proved to be golden for Goldkehlchen. Her multiple challenges and understanding of our business challenges made her an indispensable sparring partner in the consulting process. She joined us as a coach and remains with us as part of our extended team.

I was able to enjoy another great workshop at i2c last week. Petra Wolkenstein shared her knowledge on B2B negotiations with us. My personal highlight was a role-play we did. We formed teams of two-each person representing one of two parties- with the task to negotiate a deal. The scenario was about a scientist and a corporate that had to agree upon IP-rights so that they could bring a new product to the market. If successful, the deal would yield increased revenues to both, but they had different expectations towards the success chance of the project.

Unfortunately, our Founder Lab – Creative Industries at the Vienna Business Agency has now officially come to an end. But this valuable experience of building my own business with your support, so much warmth, appreciation, inspiring feedback and priceless impulses is simply incredible. Great collaborations, projects, commissions and synergies have been created. Thank you dear team for your touching farewell words to me. I am still very touched…

TRAXIT graduates from SWG OPA! With great honour and pleasure, we received our Graduation Diploma from Startup Wise Guys Online Pre Accelerator.

Big thanks to all SWG Team, and in particular Cristobal Alonso, Andrea Orlando, Asta Vasiliauskaite, Marta Madara Dundure, Karina Lapina, Andra Bagdonaitė and all supporting and external Mentors for the highly valuable insights on Pitching, Company Values and Purpose, Sales and Financials. In particular Paola Gariglio, Juan Carlos Martinez Barrio, Petra Wolkenstein and Patrick Collins, among others. We loved being there and being pushed to the limits! It was a rich and productive program.

Petra’s support with the sale of the company gave me the expertise and experience that I lacked in this area. I am delighted that we were able to bring the project to such a positive conclusion. The industry is not easy.

The sale of the company together with Konsultori went extremely well. The consultant’s experience helped with such a complex issue. The sales concept and the negotiation support were decisive.

Petra’s “let’s do it” attitude is a perfect match to the dynamics of a startup team. Her work leads to impressive results.

Petra led a strategy revision process in a dynamic, expanding medium-sized company across several divisions under time pressure. She has the ability to get the most diverse division heads on board, even with difficult topics. The result was a perfect fit.

A big “thank you” for your workshop “Debunking the investor process” in our Accelerator Programme at Gateway. It was an absolute highlight for me this year. Especially the concept of “rich or king” will be with me from now on.

Vienna, where there are many opportunities and contacts, helps us time and again. Petra Wolkenstein, who does M&A consulting, helped us with the financing round.

It was great having you here Petra, thank you for all the support for the founders!

Thanks for your great support!!

Today the very first workshop of our #growthlab went online! Great experience thanks to the guidance of Petra Wolkenstein, and the participation of our freshly selected batch members. It`s great to see people joining from the comfort of their homes, bringing in different perspectives and experiences and being involved in open discussions about their businesses.

Nice session, Petra!! Thanks for sharing your wisdom and experience.

Thanks, Petra Wolkenstein for being part of an amazing coaching team.

We just successfully wrapped up Batch 9 Riga program, and on behalf of whole SWG team I wanted to say BIG THANKS for your participation in the program and offering the teams your experience and time!

Thank you very much for your time and valuable insights.

Thank you, Petra, for your great insights on the investor readiness topic!

We really appreciate the great help and tips we received during Investor Dynamics training, and the valuable feedback and hands-on approach, which gave us a clear picture, what activities are most important for us and how to execute them.

Dear Petra! It was a pleasure for me to learn from your experience today, it was a great 2nd level negotiations workshop, I’m looking forward to applying the learned knowledge in my future meetings and negotiations.

Petra Wolkenstein provided us with very professional and helpful support in various phases. Starting with company coaching in the area of internationalisation through to support in the search for investors. Especially in this phase, the cooperation worked very well and Petra was able to find us high-quality and suitable investors. The network of investors extends far beyond the borders of Austria and has a very good breadth and depth. Thank you very much for your excellent, proactive support!

Translated with www.DeepL.com/Translator (free version)

Thank you konsultori team! It was our pleasure to be present in the vibrant Startup ecosystem that Vienna is becoming and to be part of the Wirtschaftsagentur Wien Vienna Startup program. One of the biggest advantages though was to learn from you and to work with you on our future plans.

Our Ag-Tech Startup Accelerator always aims at having motivating speakers and workshops in order to develop the founders‘ skillsets further. Petra Wolkenstein held an incredibly informative and exciting negotiations workshop where everyone had a lot fun while taking away numerous learnings. I can highly recommend her negotiations workshop to everyone who needs to improve in this field.

Thank you for the amazing negotiations training today at Startup Wiseguys and the great mentoring session!

In Petra Wolkenstein, we have found someone who will provide us with consistent and targeted support in focusing our services and, building on this, will help us to decisively develop our presence in digital and social media. The contribution of her personal experience in dealing with these media and her corresponding expertise are a decisive factor in the expansion of our customer base. I can only warmly recommend Mrs Wolkenstein. What she develops and drives forward in the start-up scene also has great applications for us as an SME. The positive development of our company over the last 5 years of working with Mrs Wolkenstein is the best proof of this.

Petra is definitely one of the very best M&A experts that I met.

Our process for a project with you

01.

Initial consultation & project outline

We engage in a thorough discussion to understand your specific needs, goals, timeline, budget, and general project requirements.

02.

Transfer and sales options

Based on the structure of your company and the ownership situation, we will define your options for a sale of your company.

03.

Maximise business valuation

We will work on activities you should undertake to maximize the potential business valuation over time before being sales-ready. We help you through the process.

04.

Buyer profiling and financial plan

We will have a strategy session to define potential buyers with one or more profiles and ways to identify them. In parallel, we will challenge and/or prepare your financial plan reflecting your strategy and benchmarks.

05.

Coordination Auditor, Lawyer

The overall process needs legal and tax advise apart from the business advise. We support in coordinating all experts.

06.

Due Diligence preparation

In the preparation of a data room for the sales process, we provide project management and support in providing a complete data room with all necessary documents.

07.

Outreach and process management

We advise on structuring the outreach and the process. Sometimes we manage the process on the customer’s behalf.

08.

Negotiation support

During the mergers & acquisition process we support on negotiation and conversations with the different parties.

Book a non-binding consultation

You are not ready yet?

Case studies

Mergers and acquisitions Opportunities on a plate in the FoodTech field

M&A Opportunities on a Plate. Successful completion of strategic cooperation with two target companies after 5 months.

Strategic investor and company sale of food startup Goldkehlchen

Preparation of the entry of a strategic investor up to the support of the entire company sale as an exit for the founder.

Company succession at beechange: Karin Haffert in an interview about her successful handover

How does a company sale work? Company succession at beechange: Karin Haffert in an interview about her successful handover.

Insights

Key ingredients for cooking up successful, sustainable collaborations in the food space

Panel discussion on the transformative power of collaboration in the food system, hosted by Konsultori as part of ViennaUP.

Panel on Food Startups and Collaborative Innovation

Explore how startups lead food sustainability through collaboration. Join us for insights and transformative discussions at ViennaUP!

Konsultori is on the ranking of Austria’s top consultants 2024

Startup Scaling – Was genau es sich dabei handelt und was es für Startups zu beachten gibt? Expertise Artikel.

Other expertise in M&A

01.

Find investors

We provide guidance on investor identification, effective approaches, business readiness assessment, document preparation, negotiation tactics, company valuation, and demonstrating value to investors.

02.

Business valuation

This session covers financial planning and analysis to support informed decision-making and goal achievement. It includes assessing liquidity, forecasting future development, creating comprehensive financial plans for external financing, attracting investors, calculating financial requirements for growth, and preparing financial plans for company assessments or sales.

03.

Financial plan

We assess liquidity, forecast future development, and provide insights into budget availability. We also assist in creating comprehensive financial plans for external financing, attracting investors, calculating financial requirements for growth, and preparing financial plans for business assessments or company sales.

04.

Harvard business negotiation

The session will cover strategies for effective negotiation, understanding the interests and motivations of the parties involved, conducting thorough preparation, developing compelling proposals, and employing effective communication and negotiation tactics.

05.

Startup M&A as a Service for Strategic Buyers

If your market is consolidating and you’re looking to strategically acquire smaller businesses, we guide you in identifying potential targets, conducting due diligence, negotiating deals, and ensuring effective integration.

Frequently asked questions

How long it takes to sell a business depends on a number of factors, such as the size and complexity of the business, current market conditions and the buyer’s due diligence process. Konsultori will work with you to establish a timetable and manage the process to ensure it is completed as efficiently as possible. Depending on the complexity, we require a lead time of 6 to 9 months to complete a purchase agreement, and for complex projects, it can take significantly longer.

The process usually involves an initial meeting with us to discuss the specifics of your business and your goals for the sale. We then conduct a thorough analysis of your business, including a valuation and market analysis. We then develop a sales strategy and start marketing your business to potential buyers. We also support you in the negotiations and closing of the sale.

The cost of working with an advisor can vary depending on the advisor and the services offered. Some advisors charge a flat fee, while others charge a percentage of the sale price. It is important to discuss the costs and any additional expenses in detail before you start the process.

We use a digital data room where you upload all documents relevant to the sale. The data room solution is well-secured and is available for you on a certified server in a data centre. Documents can be efficiently shared with prospective buyers and the handling of further questions and answers, as well as the allocation to persons who can answer, we administer in the data room solution. In this way, we work together efficiently to minimize the burden on your day-to-day business.

A selling price, also called a transaction volume, describes all payments and compensation paid to the seller by the buyer. Depending on the specification of the transaction volume, you get flexibility in how the selling price is arrived at. These can be elements such as the purchase price for the company, a consultancy contract or bonus for the selling owner, as well as a success component depending on the performance of the company in the future (earn-out clause).

For the legal and financial issues in the sale of the business, we work with your lawyer and accountant to ensure that all the necessary documents and paperwork are in order. As Konsultori, we are responsible for communicating and addressing potential buyers, negotiating and project managing through to the sale.

We support you in assessing whether your business has a chance of being sold. We do this through a thorough analysis and business valuation. We also analyse the 3 most recent financial statements, the business operations and check the general condition of the company. A business is considered ready for sale if it is profitable, has a good reputation and has a solid management team. The more profitable your business is, the higher its selling price. If your business has been through a crisis, you may want to wait a little while until the increase is visible in the figures again.

Selling 100% of your business does not necessarily have to be the right step. If you only want to sell a part at the beginning, then this is also possible.