How we can help with

Vienna Stock Exchange Direct Market

If your company has successfully navigated the expansion stage and is now ready to explore new funding opportunities, we provide guidance and support. Whether you’re looking to trade your shares, take the first step towards becoming a listed business, or are specifically planning to list your business on the Vienna Stock Exchange and direct market plus, our expertise can assist you throughout the entire process.

Your challenges are taken care of

After the initial expansion phase of your start-up, you would like to explore further financing options.

Looking for an opportunity to trade your shares?

You would like to gain access to a stock exchange listing and take the first step.

You have decided in favour of the Vienna Stock Exchange and the direct market plus and would like to be accompanied through the process.

Areas in which we work with you

Key elements of work

- We support the planning and implementation of preparatory measures, e.g. business model adjustment, financial processes, compliance processes, restructuring from GmbH to AG, and strategic adjustments

- We act as project manager

- We help you to choose the right solicitor, investment bank etc.

- We advise you on the terms of direct market plus and the consequences of being a listed company

- We produce an information memorandum

- We assess your business according to the necessary standards

- We support you with pre-negotiations with the stock exchange

- We initiate pre-listing funding rounds

Results you will get

Business valuation

Information memorandum

Compliance handbook/training

Capital market coach for 12 months

Project-lead by a senior partner

Petra Wokenstein

Petra is a highly accomplished professional with a wealth of experience in strategy and driving business growth. She specializes in providing strategic guidance and expertise in the areas of strategy, M&A, and growth. Petra is also an Investor and General Partner for Africa Startup Wise Guys, actively supporting and nurturing innovative startups in Africa.

With hands-on experience working with startups and investors since 2012, Petra has successfully led funding rounds and sales in diverse industries such as cybersecurity, eCommerce, SaaS and HealthTech. Petra’s extensive expertise, coupled with her proven ability to drive growth and navigate complex business areas, make her a valuable asset in the fields of strategy, M&A, and business development.

Expertise we bring

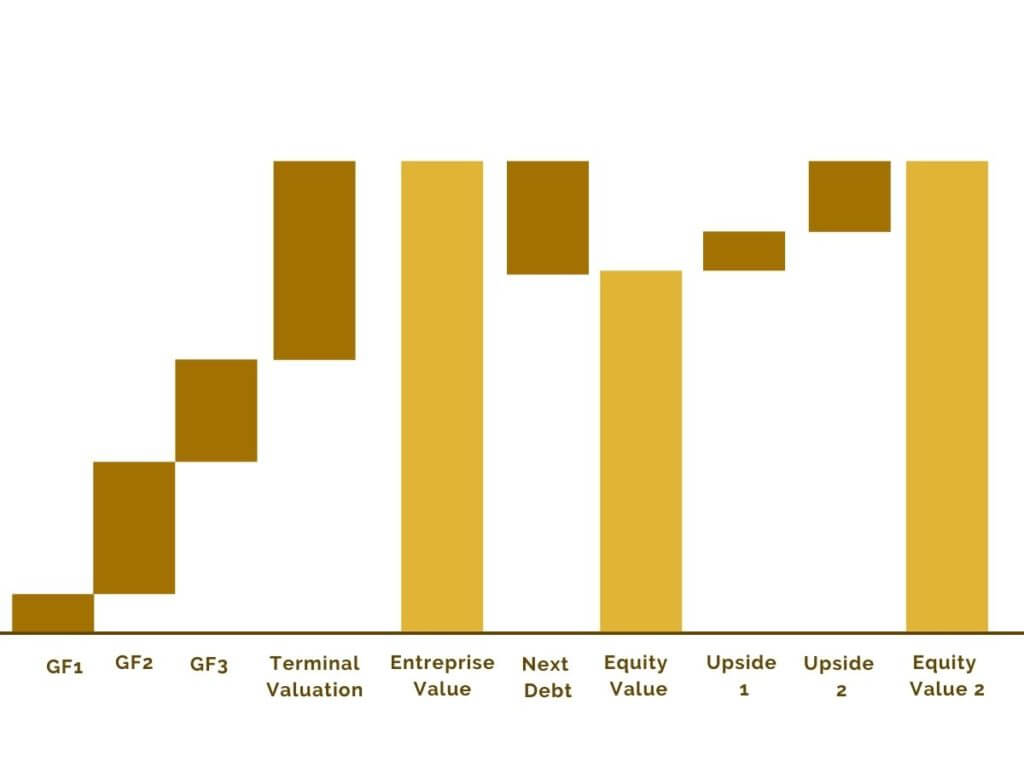

Business valuation

We specialise in business valuations for early-stage startups. At this stage, the future growth of your business is still highly uncertain, meaning special methods for valuation must be applied. Late-stage businesses use the DCF method as standard, combined with a multiples approach. Sometimes, an asset valuation is also necessary.

Equity story

Investors need a few solid arguments to explain why your business generates added value and why your business valuation is forecast to increase exponentially in the future. That is summarised in an equity story and together with your investment teaser, it is the backbone of your investment story.

Investment strategy & process

We support business sales and funding rounds with strategic or financial investors. Depending on your industry, different processes need to be defined in order to be able to manage and complete the process within the scheduled timeframe.

Direct funding partner accreditation at the Vienna Stock Exchange

Konsultori has been an accredited direct funding partner at the Vienna Stock Exchange since June 2019. We help growth-stage SMEs and startups with funding rounds prior to listing on the stock exchange, as well as during rounds on the way to becoming a listed business. We bring businesses and investors together and act as consultants for the preparation of such meetings.

Very competent in providing tools and strategies. I always feel a genuine passion for the mission to empower startups. Thank you!

Konsultori and Petra Wolkenstein are extremely professional. Her experience really helped us to get through the first funding round. We were thrilled that the documents and arguments which we produced in the preparations stage were so well received in our search for investors and during negotiations. I appreciated such a straightforward, hassle-free and honest partner who never forgot our goals and timeline. Without Konsultori, we’d never have managed to achieve everything within such a short space of time.

Our participants enjoyed her session on Negotiation In Action which imparted them with the confidence to get what they want. Petra shared her most important negotiation techniques, practical exercises as well as a confidence-building framework that the leaders can put into practice right away!

Petra Wolkenstein your lecture on negotiation was so insightful and engaging, thank you! You are a great storyteller!

Thank you a lot for the session this week! Some of the feedback from the founders (NPS 100!): The practical approach. Petra was super useful and clear and knowledgeable. The practical exercise super useful points for the negotiations. The combination of theory and practice. Even though we only learned about term sheets the negotiation practice was very useful and, in fact, helped us understand terms sheets better. The exercise was really interesting and a good insight into negotiation practice. It has been really great the best exercise I’ve done in the startup world!

I really enjoyed the workshop with you and many of my TU Wien Innovation Incubation Center pals the other day! Honestly one of the best workshops I have ever attended and probably with much more interaction from all sides compared to some offline workshops.

Hey Petra! Really enjoyed your session. Valuable content and learnings.

Thank you Petra! I want to share the comments received from the founders on the feedback form: “Amazing lesson should be a must for any founder, and life in general.It was really useful from a practical standpoint, clearly and helpfully delivered and felt like a safe space to learn, make mistakes, grow better. This is really great, would love to have more practice on this topic, and so I am going to make sure I use any materials available to work on it more.Great session. ! I don’t like role plays so was dreading it, but that was very useful. Thank you! The practice part was very cool a bit more of „hardcore“ examples and tactics, seemed too nice! Interesting topic I was expecting to get to go more in depth of special techniques of negotiation, maybe doing the simulation after the explanation of techniques so that you can apply. Liked all of it! The interactive element was strong and really enjoyable.”

The #LeadF programme provided the space and guidance for introspection, allowing me to reflect on my journey thus far and lay the groundwork for a more rewarding and enduring entrepreneurial adventure. I’m immensely grateful for all sessions held by Rebecca Williams, Annabelle Bockwoldt, Emma Stamiri, Amelia Suda-Gosch, Nina Mueller, Rupal Patel, Paulo André, Petra Wolkenstein, Preethi Sundaram. Your stories have enabled me to gain a deeper understanding of myself and chart a path for continued growth.

I run the Vienna Business Agency’s “Founders Lab” programme, during which I provide intensive support to early-stage start-ups over three months. Workshops and coaching sessions with Konsultori are a central part of the programme. The founders, regardless of their industry, benefit enormously from Petra’s, Franziska’s and Joachim’s input on the topics of business modelling, finance, negotiations and investments. Konsultori’s wealth of experience, expertise and approachability is a great asset to the startup ecosystem in Vienna.

Our collaboration with Petra has been a privilege, and without hesitation, we attest to her skills as a mentor and industry expert. Given Grayn’s position as an innovative technology company, with a focus on both environmental and social impact data, Petra’s guidance has played a pivotal role in navigating the intricacies of our expansion into the DACH region, specifically Austria. By leveraging our carefully crafted sales and market expansion strategy, Grayn achieved a heightened level of efficiency and success in penetrating the Austrian market. Petra’s expertise played a vital role in this accomplishment, allowing us to navigate the complexities of the local business landscape with confidence and precision. As a result, we were able to establish a strong foothold and make significant progress in our mission to promote sustainable accounting practices in Austria.

I had the privilege to widen my skills through the Female Founders program #LeadF and learn from top-class speakers such as Petra Wolkenstein, Rebecca Williams and Preethi Sundaram just to name a few! Thank you!

Petra Wolkenstein’s coaching for LENA is brilliant. She works in a structured way but is always open to out-of-the-box thinking. She takes an analytical approach and inspires us with her input and ideas. Her great sense of humour makes every session feel more like fun than work.

I just re-watched your videos. They are fantastic! Thank you for such a structured attitude. The “templates-based” training is excellent! Also, lots of great insights into how an investor thinks during the Q&A sessions.

Hi, once again Petra! Thank you for such an energetic session. It is absolutely excellent and highly valuable.

Competence. Experience. Excellence. Full Commitment! Thank you for all the great workshops and the coaching.

Petra helped us in structuring the key message and all relating documents for finding venture capital for a newly founded start-up in the field of green chemicals. Petra also provided us contacts and venture opportunities for our mission. We totally appreciated Petras’s very experienced, well-skilled but still hands-on way of working with us. Petra is perfectly capable of sensing what her customers really need. We really learned a lot! Thank you, Petra.

Petra’s highly structured and positive approach proved to be golden for Goldkehlchen. Her multiple challenges and understanding of our business challenges made her an indispensable sparring partner in the consulting process. She joined us as a coach and remains with us as part of our extended team.

I was able to enjoy another great workshop at i2c last week. Petra Wolkenstein shared her knowledge on B2B negotiations with us. My personal highlight was a role-play we did. We formed teams of two-each person representing one of two parties- with the task to negotiate a deal. The scenario was about a scientist and a corporate that had to agree upon IP-rights so that they could bring a new product to the market. If successful, the deal would yield increased revenues to both, but they had different expectations towards the success chance of the project.

Unfortunately, our Founder Lab – Creative Industries at the Vienna Business Agency has now officially come to an end. But this valuable experience of building my own business with your support, so much warmth, appreciation, inspiring feedback and priceless impulses is simply incredible. Great collaborations, projects, commissions and synergies have been created. Thank you dear team for your touching farewell words to me. I am still very touched…

TRAXIT graduates from SWG OPA! With great honour and pleasure, we received our Graduation Diploma from Startup Wise Guys Online Pre Accelerator.

Big thanks to all SWG Team, and in particular Cristobal Alonso, Andrea Orlando, Asta Vasiliauskaite, Marta Madara Dundure, Karina Lapina, Andra Bagdonaitė and all supporting and external Mentors for the highly valuable insights on Pitching, Company Values and Purpose, Sales and Financials. In particular Paola Gariglio, Juan Carlos Martinez Barrio, Petra Wolkenstein and Patrick Collins, among others. We loved being there and being pushed to the limits! It was a rich and productive program.

Petra’s support with the sale of the company gave me the expertise and experience that I lacked in this area. I am delighted that we were able to bring the project to such a positive conclusion. The industry is not easy.

The sale of the company together with Konsultori went extremely well. The consultant’s experience helped with such a complex issue. The sales concept and the negotiation support were decisive.

Petra’s “let’s do it” attitude is a perfect match to the dynamics of a startup team. Her work leads to impressive results.

Petra led a strategy revision process in a dynamic, expanding medium-sized company across several divisions under time pressure. She has the ability to get the most diverse division heads on board, even with difficult topics. The result was a perfect fit.

A big “thank you” for your workshop “Debunking the investor process” in our Accelerator Programme at Gateway. It was an absolute highlight for me this year. Especially the concept of “rich or king” will be with me from now on.

Vienna, where there are many opportunities and contacts, helps us time and again. Petra Wolkenstein, who does M&A consulting, helped us with the financing round.

It was great having you here Petra, thank you for all the support for the founders!

Thanks for your great support!!

Today the very first workshop of our #growthlab went online! Great experience thanks to the guidance of Petra Wolkenstein, and the participation of our freshly selected batch members. It`s great to see people joining from the comfort of their homes, bringing in different perspectives and experiences and being involved in open discussions about their businesses.

Nice session, Petra!! Thanks for sharing your wisdom and experience.

Thanks, Petra Wolkenstein for being part of an amazing coaching team.

We just successfully wrapped up Batch 9 Riga program, and on behalf of whole SWG team I wanted to say BIG THANKS for your participation in the program and offering the teams your experience and time!

Thank you very much for your time and valuable insights.

Thank you, Petra, for your great insights on the investor readiness topic!

We really appreciate the great help and tips we received during Investor Dynamics training, and the valuable feedback and hands-on approach, which gave us a clear picture, what activities are most important for us and how to execute them.

Dear Petra! It was a pleasure for me to learn from your experience today, it was a great 2nd level negotiations workshop, I’m looking forward to applying the learned knowledge in my future meetings and negotiations.

Petra Wolkenstein provided us with very professional and helpful support in various phases. Starting with company coaching in the area of internationalisation through to support in the search for investors. Especially in this phase, the cooperation worked very well and Petra was able to find us high-quality and suitable investors. The network of investors extends far beyond the borders of Austria and has a very good breadth and depth. Thank you very much for your excellent, proactive support!

Translated with www.DeepL.com/Translator (free version)

Thank you konsultori team! It was our pleasure to be present in the vibrant Startup ecosystem that Vienna is becoming and to be part of the Wirtschaftsagentur Wien Vienna Startup program. One of the biggest advantages though was to learn from you and to work with you on our future plans.

Our Ag-Tech Startup Accelerator always aims at having motivating speakers and workshops in order to develop the founders‘ skillsets further. Petra Wolkenstein held an incredibly informative and exciting negotiations workshop where everyone had a lot fun while taking away numerous learnings. I can highly recommend her negotiations workshop to everyone who needs to improve in this field.

Thank you for the amazing negotiations training today at Startup Wiseguys and the great mentoring session!

In Petra Wolkenstein, we have found someone who will provide us with consistent and targeted support in focusing our services and, building on this, will help us to decisively develop our presence in digital and social media. The contribution of her personal experience in dealing with these media and her corresponding expertise are a decisive factor in the expansion of our customer base. I can only warmly recommend Mrs Wolkenstein. What she develops and drives forward in the start-up scene also has great applications for us as an SME. The positive development of our company over the last 5 years of working with Mrs Wolkenstein is the best proof of this.

Petra is definitely one of the very best M&A experts that I met.

Our process for a project with you

01.

Initial consultation & project outline

We engage in a thorough discussion to understand your specific needs, goals, timeline, budget, and general project requirements.

02.

Direct market+ readiness

We advise on the terms of direct market plus and the consequences of being a listed business.

03.

Action plan and support in implementation

We accompany the planning and implementation of preparatory measures, e.g. business model adjustments, financial processes, compliance, etc.

04.

Challenging financial plan and valuation

We analyse and provide feedback on financial planning and valuation.

05.

Information memorandum

We assess your business according to the necessary standards. We produce an information memorandum.

06.

Stock exchange conversations

We support you with pre-negotiations with the stock exchange and initiate the pre-listing funding rounds.

07.

Compliance Handbook and workshop

We prepare the compliance handbook and training.

08.

Capital Market Coach for 12 months

We support you as a capital market coach during the first 12 months of listing.

How we support you

Advisory

Individual projects tailored to your situation but based on our proven framework and approach. You work with your Konsultori expert or team.

Case studies

Investor acquisition of an industry platform

Challenges in attracting investors. Preparation of investor meetings, company valuation, and negotiation support.

Financial planning and investor search at startup go2market

Investor search. Financial planning. Startup company valuation. Konsultori accompanies go2market on a successful development path.

Supporting a cybersecurity Series A round

Supporting the Series A financing round of the cybersecurity startup Whalebone. Preparation of documents for investor meetings.

Other expertise in M&A

01.

Find investors

We provide guidance on investor identification, effective approaches, business readiness assessment, document preparation, negotiation tactics, company valuation, and demonstrating value to investors.

02.

Selling your company

We support you with strategic guidance in the preparation and selling of your company including valuation, potential buyer identification, deal structuring, due diligence, and executing the exit strategy.

03.

Financial plan

We support you and establish your financial plan or a revision of it. You will be able to communicate with financing partners and steer your company with a well-thought-through financial plan based on a proven tool.

04.

Harvard business negotiation

We work with you on your current negotiation challenge with tactics, preparation, guidance, briefing, and debriefing, as well as process and analysis to improve your negotiation results.

05.

Startup M&A as a Service for Strategic Buyers

If your market is consolidating and you’re looking to strategically acquire smaller businesses, we guide you in identifying potential targets, conducting due diligence, negotiating deals, and ensuring effective integration.

06.

Business valuation

We develop, document, and provide the argumentation of a well-analyzed and benchmarked business valuation for your company.